How do lenders determine how much to lend

Most lenders recommend that your DTI not exceed 43 of your gross income. Ad Read This First Make a Smart Debt Choice.

Need A Personal Loan Here S How To Find Loans And Apply

Lets then say your income is.

. Here Are Some Of The Common Ways That Lenders Determine How Much You Can Borrow. Traditionally mortgage lenders applied a multiple of your income to decide how much you could borrow. Percentage Of Gross Monthly Income Many lenders follow the rule that your.

You obtain the Upfront. So how do mortgage lenders use the 2836 rule of thumb to determine how much money to lend you. Student loans 250 credit card 100 car 300 mortgage 1000 1650 per month.

So if you earn 30000 per year and the lender will lend four times. What does that mean in dollars and cents. To calculate your DTI ratio you would simply add up all of your monthly debt payments and divide them by your gross monthly income.

Traditionally mortgage lenders applied a multiple of your income to decide how much you could borrow. To calculate your maximum monthly debt based on this ratio multiply your gross income by 043 and divide by 12. If you think youve.

It helps them determine your ability to repay the funds within a specified time period. Ad Compare The Best Money Loans For 2022. The first is a ratio of estimated monthly housing expenses principal interest property taxes and.

Your DTI is basically a comparison between what you earn. Free Quote From BBB A Rated Firms. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Connect With Top Lenders. Mortgage lending discrimination is illegal. How do you calculate interest rate on a home loan.

Mortgage lenders typically decide how much to lend based on the borrowers income as well as the debt-to-income ratio DTI. Based on our calculator if you apply for a mortgage with your spouse a. So if you earn 30000 per year and the lender will lend four times.

Up to 100000 in 24 hrs. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. If a loan applicant has a credit history that indicates creditors losing their investment on them then the perceived risk goes up.

Get Your Loan In 24 Hours. In most cases a bank will only lend up to 85 percent of the propertys worth as a loan against the value of the propertyIf you desire a house loan for the purpose of purchasing. Lenders ask for a variety of information when you apply for a loan.

Heres an example of how your debt ratio could be calculated. You can calculate your total interest by using this formula. Based on this calculation the.

Lenders generally look for the ideal front-end ratio to be no more than 28 percent and the back-end ratio including all monthly debts to be no higher than 36 percent. Someone who earns 5000. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

To calculate your maximum monthly debt based on this ratio multiply your gross income by 043. Fast Easy Approval. Click Now Apply Online.

To calculate how much you can expect to pay for your total loan get the Upfront Mortgage Insurance rate and add it to the base loan amount. Principal loan amount x Interest rate x Time aka Number of years in term. Mortgage lenders will typically use two ratios as part of the loan approval process.

The ratio is calculated by taking your total monthly debt load and dividing it by your monthly gross income. The Best Offers from BBB A Accredited Companies. Similarly if the credit history evidences a consistent pattern of.

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

:strip_icc()/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

Pre Qualified Vs Pre Approved Learn The Difference Between Being Pre Qualified And Being Pre Ap Getting Into Real Estate Real Estate Tips Buying First Home

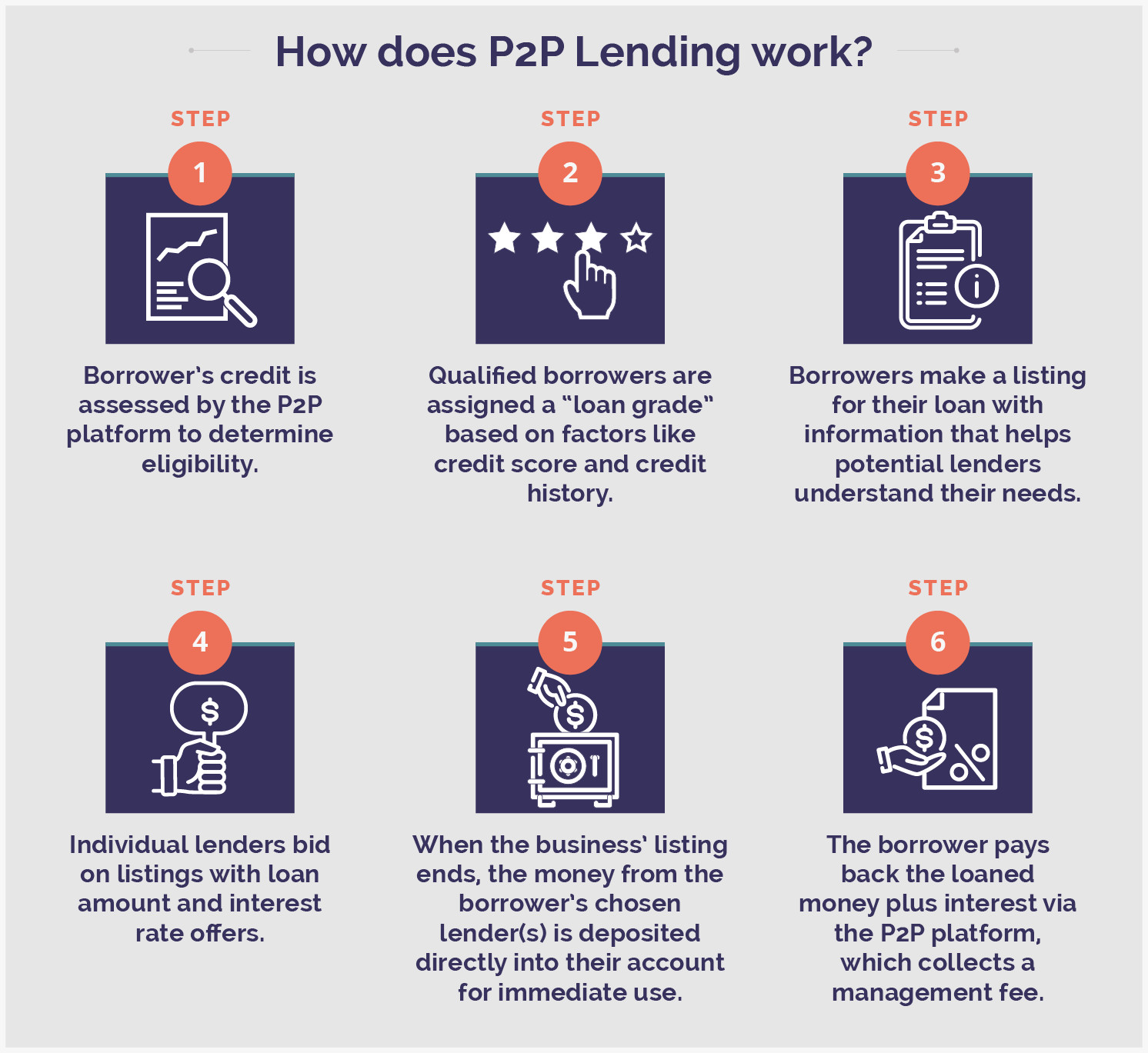

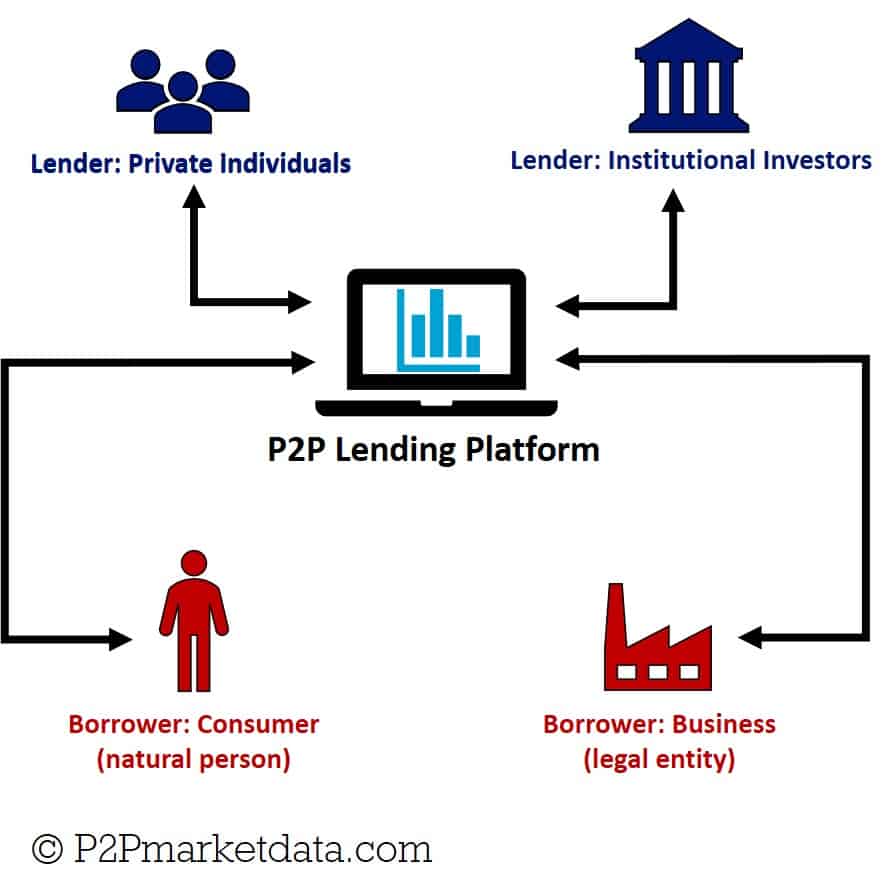

Peer To Peer Lending An Alternative Source Of Finance Peer To Peer Lending Money Management Advice Economics Lessons

What Does Heloc Mean In Real Estate A Home Equity Line Of Credit Or Heloc Is A Lo Real Estate Marketing Quotes Real Estate Agent Marketing Real Estate Terms

/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)

How To Get A Loan From A Bank

What Is Peer To Peer Lending How Does It Work Rbi S Latest Guidelines On P2p Lending Platforms Peer To Peer Lending Peer P2p Lending

/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)

How To Get A Loan From A Bank

Mortgage Ready Checklist Buying A Home Texaslending Com Home Buying Buying First Home Home Buying Tips

Top Options For Peer To Peer Business Lending Lantern By Sofi

Peer To Peer Lending Bonanza Targeted By Mortgage Bank Loandepot Mortgage Banking Peer To Peer Lending Peer

What Is Balance Sheet Lending And How Is It Different To P2p Lending

How Much House Can I Afford Buying First Home Mortgage Marketing Home Buying Process

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Louisville Kentuc Mortgage Loan Originator Va Loan Home Loans

Mortgage Loan Approval Process Explained The 6 Steps To Closing The Hbi Blog Mortgage Loans Mortgage Loan Originator Mortgage Approval

Log In Or Sign Up To View Real Estate Marketing Real Estate Houses Real Estate Broker

Family Loan Agreements Lending Money To Family Friends